More than 85% of the global population has a mobile phone and these devices have a profound impact on people’s lives. The average US consumer is never more than three feet away from their mobile, with the average smartphone user checking their device 40 times a day according to Google.

But it’s in the developing markets where its impact is most visible. Mobile technology and the mobile Internet have revolutionised Africa in ways that few outside the continent would understand, enabling communication and commerce where it was often virtually impossible before.

The number of people in China who only access the Internet via their mobile device has now surpassed the number who accesses it through their PC or laptop. This ‘mobile only’ Internet trend is also prevalent in developed markets, our latest research shows 25% of UK users only use their mobile to access the Internet as its more convenient, already switched on and can be used on the go.

As mobile technology advances with the roll out of 4G technology, people’s frequency of use, consumption of content and dependency on mobile devices, will increase even more. Advanced mobile technology also has positive implications for both the mobile research industry, and for respondents taking mobile surveys.

Future impact

Faster Internet connection speeds thanks to 4G, will make it more convenient for respondents to take surveys on their mobile devices. It will allow them to check in on their mobile and record their activities ‘in the moment’, which will lead to more accurate and insightful results.

Faster connection speeds will also negate the need for respondents to download a mobile survey app, as mobile surveys working in a browser will be just as usable, with the added flexibility of working on any web-enabled device. It also means that researchers do not need to commission expensive apps, to carry out mobile research.

Surveys taken via the mobile Internet will load faster, so they can be completed in less time, resulting in more satisfied respondents, higher completion rates and ultimately better quality data for clients.

Wider coverage will also allow researchers to connect with consumers in rural areas that previously had limited connectivity. Increased data capacity should also bring the ability to customise client surveys to a higher quality, adding in high-res logos, images, videos and graphics, also allowing for ad testing to be completed on mobile devices.

Increased upload speeds will make it faster and easier for respondents to share pictures and video, providing a valuable resource for new and dynamic content to bring number-heavy research presentations to life.

Research response

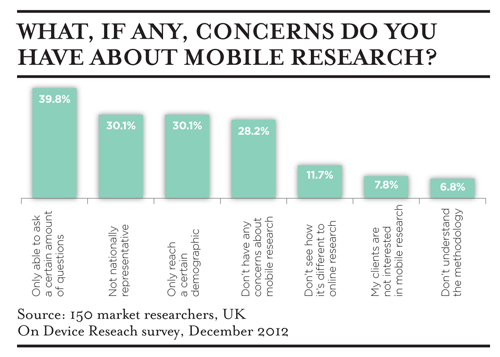

Mobile research is undoubtedly an exciting opportunity, but there are also some concerns that are hindering its uptake, which is understandable as it’s a relatively new methodology with its own set of challenges. To understand these concerns, we surveyed 150 market researchers in the UK, who use a broad spectrum of research methodologies.

The top concerns were that mobile methodology limits the number of questions that can be asked (39.8%) and data is not nationally representative (30.1%). There was also a lack of understanding about the methodology.

To encourager broader adoption, mobile researchers need to address these issues to strengthen confidence in the methodology. We, at On Device Research, have attempted to tackle some of these issues.

Limited questions

To determine the optimal amount of questions to ask in a survey, we analysed over a million survey-completion and drop off rates, including surveys that had up to 30 questions. The results showed that 15 is the optimal number of questions after which the percentage of people who drop off per question doubles, and this includes people who are being paid to take the survey.

Life is busy, and respondents have a short attention span before they get frustrated and lose interest in answering surveys, so we advise clients to stick to 15 questions. If they really need more questions, you can, for example run two separate surveys on consecutive days.

We also advise clients that whilst mobile is great for getting quick answers to questions and mobile diaries can generate a lot of information, if really in-depth research is required then focus groups, or face to face interviewing might be more appropriate. Mobile works well alongside other research methodologies, it does not have to be a replacement.

Not representative

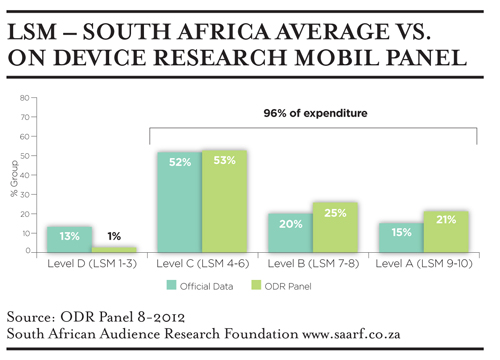

Mobile research is not nationally representative, and in the interests of good data quality, mobile researchers should make this very clear and be transparent about which demographic groups, their panels are representative of. We compare our panels to census data and where possible socio-demographic groups.

For instance, we compared our panels to their Living Standards Measure (LSM) scale in South Africa. LSM is a unique means of segmenting the South African market and divides the population into 10 LSM groups, 10 (highest) to 1 (lowest) and is similar to social economic grouping.

We found that our panels were only representative of LSM groups 4 to 10, but these groups equated to 96% of South Africa’s income and expenditure, so you could say that although mobile doesn’t reach all of society, it does reach the segment with the most spending power.

In developed markets, mobile is great for connecting with the traditionally hard to reach audiences such as young people in the 16-34 age group but might be less appropriate to reach the 55+ age group, unless clients are prepared to incur expensive recruitment costs. This will change, as mobile adoption continues but transparency from mobile researchers is key to addressing this issue.

Understand the methodology

Not all clients and researchers understand the mobile research methodology and its advantages and this might hinder uptake. People want to know why they should use mobile, and what this methodology can achieve.

The responsibility for this lies with mobile research companies. We have just launched our own ‘Inform and Inspire’ sessions, where clients and market researchers are given an overview of the mobile landscape and presented with case studies of how mobile research has been used, to inspire them and showcase the possibilities that mobile opens up.

There has never been a better time for mobile-based research methods to get timely and cost-effective insights in developing markets. Or to conduct ‘in the moment’ research, track location-based advertising and ask respondents to check in when they carry out an activity or see an advertisement in developed markets.

As the mobile space continues to grow and become even more innovative, so will mobile research, but success depends on inspiring and giving confidence in the methodology, to the wider research industry.